Affordability

With few affordable homes available in Sulphur Springs and limited homes available in the city in general, concerned citizens as well as city officials have proposed solutions to address the city’s current housing shortage.

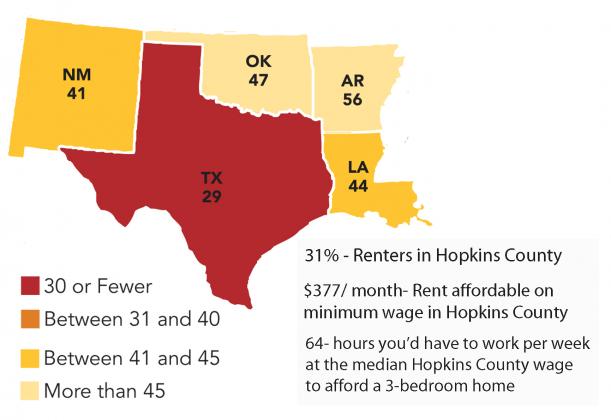

Texas is in an extreme affordable housing crisis, according to the National Low Income Housing Coalition, with fewer than 30 out of 100 homes classified as affordable statewide.

In Sulphur Springs, the median home price has risen to $160,000 in 2019, according to North Texas Real Estate Information Systems (NTREIS). The federal government defines affordable housing as housing which accounts for a third or less of monthly income.

The median annual income in Hopkins County is $47,832, according to Data USA. Monthly before taxes, this is $3,986. For housing to be considered affordable in Hopkins County, a person would have to spend $1,328 or less per month.

While this may seem like a high enough number, says Jed Walker, a local real estate appraiser, one needs to take other factors into consideration.

“Forty thousand is the median income,” Walker said. “That means half of people make more than that, but half of people make less than that.”

Walker appeared before the June regular session of the city council during citizen participation to make a plea for more affordable housing.

“Y’all have done a wonderful job bringing people here... “ Walker told the council. “Now that they’re here, it’s created a housing market issue.”

According to Walker, home sales in Sulphur Springs over the past 3 years have jumped by 40%, he said. NTREIS data confirms Walker’s numbers.

“This has priced out the average family in Sulphur Springs,” Walker said when addressing the council.

Further NTREIS data suggests that between 2017 and 2019, sales of homes in the $100 or less per square foot price range have halved, while sales of homes in the $200-$250 per square foot price range have doubled.

That means that home-buyers in the 75482 zip code are buying much more expensive homes than they were two years ago, according to NTREIS data.

“We’re having a housing crisis, period,” City Manager Marc Maxwell agreed. “We don’t have any housing at any price point.”

“We’ve got buyers with no houses,” Maxwell said. “It’s simple supply and demand… and there’s no supply.”

The solution, Walker told the News-Telegram, is for the city to step in.

“There are certain parts of town I’ve identified that could easily be developed again for minimal cost,” Walker said.

Walker refers to the undeveloped end of Brinker Street off of Lee Street between Texas and Georgia Streets. Currently owned by a private individual, the unfinished street and plots back on to Our Savior Lutheran Church and Kings and Priests Ministry.

“They could put in several homes and over time, not only would that help alleviate the stress on the housing market… but they could get the additional tax money from those homes,” he said.

Currently, Walker claims, new construction in the city is being developed outside city limits where the city cannot collect taxes on the properties.

Walker’s plan calls for the city to acquire the plots from the private individual through an eminent domain bid process and then subsidize the lots for developers to build approximately 20 single-family, two-bedroom, two-bath homes in the $140,000 price range.

“They already have that platted to finish out developing, they just never did it,” Walker said. “At the time, there was no demand for it. Well, now there is a demand for it.”

By subsidizing lots for builders to construct homes in the $140,000 range, Walker says, homes whose prices that have artificially been driven up by demand will go back down.

While Maxwell agrees that there are currently underdeveloped areas builders could capitalize on, he disagrees that the city should take an active role in annexing undeveloped private land.

“We cannot condemn property for commercial purposes,” Maxwell said. “Condemning it [a property] for a developer to develop houses on would send me to jail as much as I would like to improve the housing stock in Sulphur Springs.”

“Every session, the legislature tightens up eminent domain,” Maxwell said. Maxwell refers to SB 421 passed in May 2019.

Maxwell says that the area most “ripe for development” is a 7-acre tract named the Harris plot for the street that used to run through it bounded by Locust, Moore, Nicholson and Ingraham streets.

The plot is currently for sale, according to Maxwell.

“That’s what free enterprise does,” Maxwell said.

Jay Julian Jr., a local resident, does not think the government should play any role in developing housing for the city. A member of the Zoning Board of Adjustments, Julian spoke to the News-Telegram as a citizen.

“Tax and funding issues are not unique to Sulphur Springs,” Julian said. “Instead of growing government and taking a government first approach… I would like to see some sort of nondenominational [faith-based] organization with its collective mission being to provide affordable housing to those in need.”

Julian used the example of a 2017 ordinance spearheaded by several local, interdenominational churches to restrict payday lenders within the city limits.

According to Share Faith’s Texas Church Directory, there are as many as 17,000 Christian worshipers out of Hopkins County’s population of 36,493.

While Julian’s plan calls for interdenominational faith-based groups to develop one or few new houses or renovations per year, Maxwell says larger developments, such as a continuation of the Oak Grove development, are currently underway for approximately the price point that Walker mentioned.

According to Walker, however, the problem is not just increased cost of homes. “Food has gotten more expensive,” he said. “Childcare has gotten more expensive. Everything has gotten more expensive… retirements aren’t lasting as long… social security checks don’t really cut it anymore.

“I see some of the money they’re spending on some of these projects like the [Pacific] park… it could be spent on a three-bed, two-bath brick home,” Walker said. “When you’re this size of a town, it doesn’t take much to make the housing market go up or down.”

* Publication or display ofMLS data is deemed reliable, but is not guaranteed accurate by the MLS or NTREIS